Bonus Depreciation 2024 Used Equipment

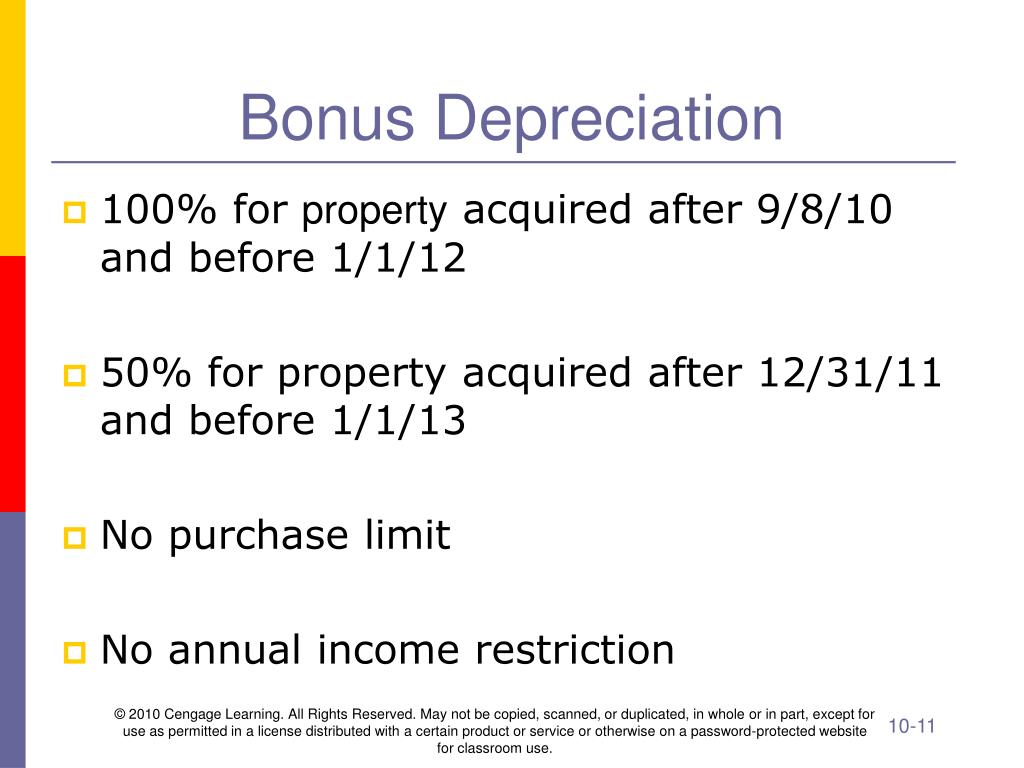

Bonus Depreciation 2024 Used Equipment. It allows you to deduct up to 100% of the purchase price. You must add otherwise allowable depreciation on the equipment during the period of construction to the basis of your improvements.

Bonus depreciation can be a valuable tax break for businesses that purchase furniture, equipment, and other fixed assets. Compare prices, reviews, ratings, features and more at kelley blue book.

Bonus Depreciation 2024 Used Equipment Images References :

Source: ninonqfrances.pages.dev

Source: ninonqfrances.pages.dev

Bonus Depreciation 2024 Percentage Change Ted Shantee, When leveraged properly, these deductions can result in substantial tax savings.

Source: cathyleenwchanna.pages.dev

Source: cathyleenwchanna.pages.dev

2024 Vehicle Bonus Depreciation Debi Mollie, Using section 179 is easy.

Source: aureliawsilva.pages.dev

Source: aureliawsilva.pages.dev

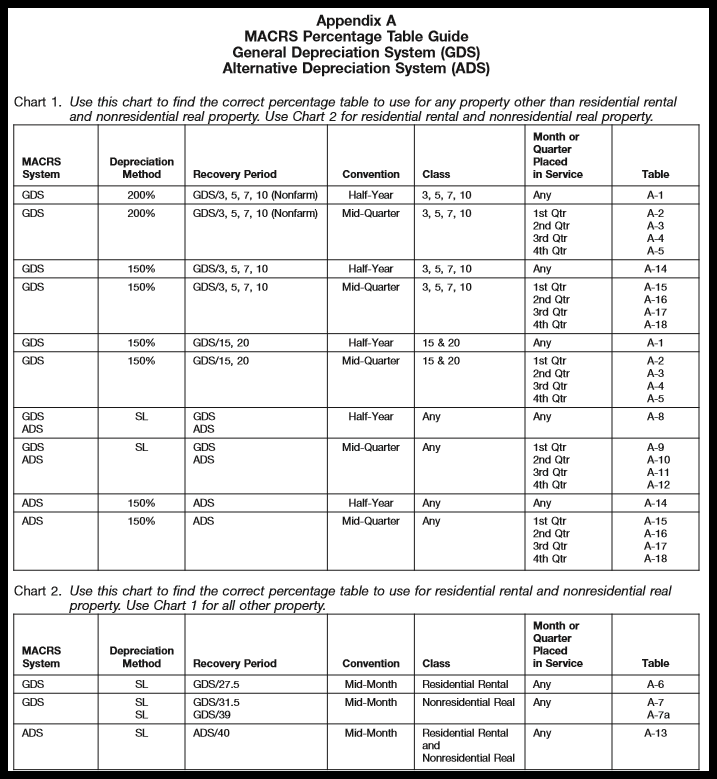

2024 Bonus Depreciation Percentage Table Debbie Kendra, The new law for “bonus” depreciation has been expanded to include used property if it meets certain requirements.

Source: sailsojourn.com

Source: sailsojourn.com

8 ways to calculate depreciation in Excel (2024), Compare prices, reviews, ratings, features and more at kelley blue book.

Source: globalfinishing.com

Source: globalfinishing.com

Valuable Tax Savings on Capital Equipment Through Bonus Depreciation, It's designed to encourage investment in new.

Source: zeldaqbernadette.pages.dev

Source: zeldaqbernadette.pages.dev

Bonus Depreciation Limits 2024 Dita Donella, Eat) today announced financial results for the fourth quarter ended june 26, 2024,.

Source: www.educba.com

Source: www.educba.com

Bonus Depreciation Definition, Examples, Characteristics, It allows you to deduct up to 100% of the purchase price.

Source: www.youtube.com

Source: www.youtube.com

Preparing for the End of 100 Bonus Depreciation for Equipment YouTube, The expensing limit was doubled from.

The new equipment will have a cost of 600,000, and it is eligible for, Discover the 2024 hyundai santa fe, a spacious and versatile suv with a boxy design.

Source: www.wikihow.com

Source: www.wikihow.com

4 Ways to Depreciate Equipment wikiHow, As a result, businesses leasing equipment in 2024 will still be able to take advantage of bonus depreciation, albeit at a lower rate than in preceding years.

Category: 2024