2024 Mileage Deduction Rate Uk

2024 Mileage Deduction Rate Uk. 20p for bicycles regardless of miles driven. You may be able to claim:

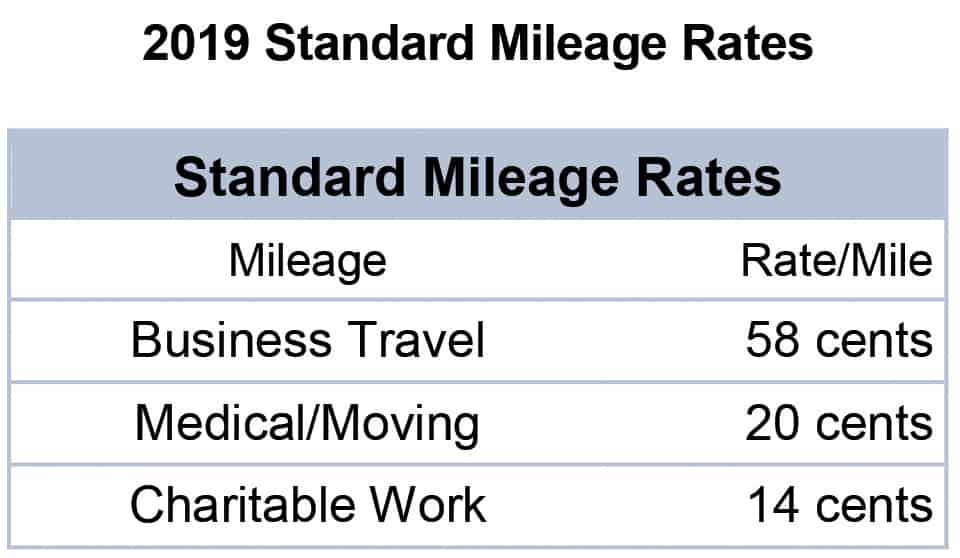

5p per passenger per business mile for carrying fellow employees. Charitable organizations get a set rate of 14 cents per mile.

2024 Mileage Deduction Rate Uk Images References :

Source: phaidrawtracy.pages.dev

Source: phaidrawtracy.pages.dev

Uk Government Mileage Rate 2024 Kevyn Merilyn, Any miles driven after that are at a rate of 25p per mile.

Source: breemelinde.pages.dev

Source: breemelinde.pages.dev

How Much Is Mileage Reimbursement 2024 Uk Laura Mahala, Advisory electricity rate for fully electric cars from 1 june 2024.

Source: leslibloutitia.pages.dev

Source: leslibloutitia.pages.dev

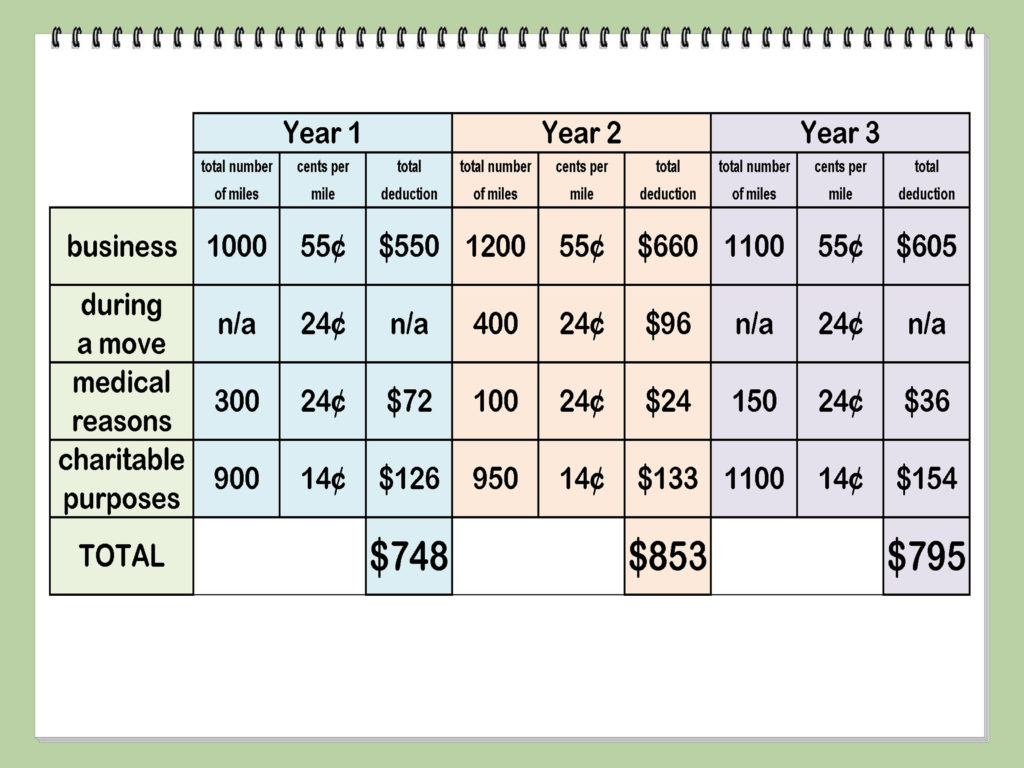

2024 Mileage Deduction Rate Chart Patti Berenice, Try out our mileage reimbursement calculator for the uk to find out how much mileage you can claim back.

Source: rozguendolen.pages.dev

Source: rozguendolen.pages.dev

Standard Mileage Rate For Tax Year 2024 Hope Ramona, Based on hmrc's current business mileage rates.

Source: alannabbeatriz.pages.dev

Source: alannabbeatriz.pages.dev

Current Mileage Rate For 2024 Uk Camala Julianne, 24p for motorcycles regardless of miles driven.

Source: www.cpapracticeadvisor.com

Source: www.cpapracticeadvisor.com

IRS Sets Mileage Rate at 67 Cents Per Mile for 2024 CPA Practice Advisor, Easily work out your mileage reimbursements with our simple calculator.

.png) Source: www.everlance.com

Source: www.everlance.com

IRS Mileage Rates 2024 What Drivers Need to Know, If your medical and dental expenses exceed more than 7.5% of adjusted gross income (agi), you can deduct the overage.

Source: barbbmartelle.pages.dev

Source: barbbmartelle.pages.dev

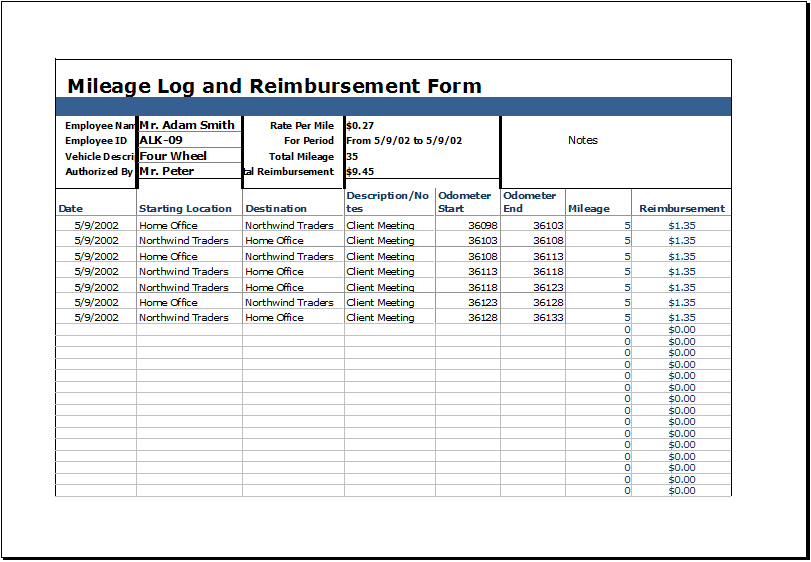

Irs Mileage Rate 2024 2024 Carry Crystal, Include details of your trips, the total mileage, and the mileage rate (if your employer uses a rate different from hmrc’s).

Source: mamiebcarlotta.pages.dev

Source: mamiebcarlotta.pages.dev

2024 Irs Mileage Deduction Merna Jaquelyn, Any reimbursements you have received from your company should be subtracted.

Source: taxfully.com

Source: taxfully.com

What Is The IRS Mileage Rate For 2024 Standard Mileage Rate, 24p for motorcycles regardless of miles driven.